SAP - Paymetric Solution Workflows

This topic illustrates and defines the high-level landscape and workflow for electronic payments and tokenization with the On-Demand services. There are separate workflows for payment (XiPay) and tokenization (XiSecure) with and without Intercept.

Workflow with Intercept

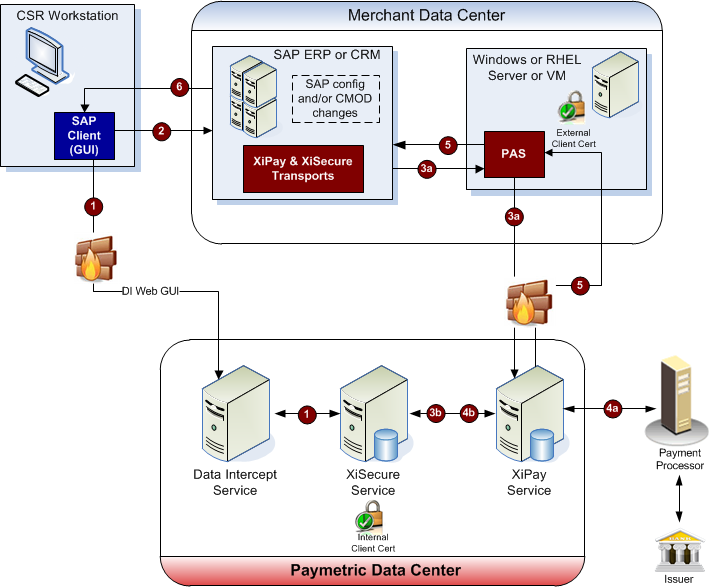

The following diagram illustrates the payment and tokenization workflow using the Data Intercept solution. SAP connects first with Intercept so credit cards are never entered into any of the merchant's systems.

1a – The system allows you to enter a defined letter in the credit card number field that invokes the transfer method, a token is generated, and the token is then automatically entered into the credit card field in the SAP GUI Client via a defined keystroke or using F4 help.

1b – Intercept Standalone communicates with XiSecure to obtain the token.

2 – The authorization or settlement request is made to the SAP ERP or CRM system from the implemented SAP Order Entry screen(s). For authorizations, a token is saved in the standard SAP Credit Card Number Database field.

3a – The ERP or CRM system sends authorization or settlement requests via a TCPIP RFC call through PAS to the appropriate XiPay Web Service operation.

3b – XiPay communicates with XiSecure as needed to perform tokenize/detokenize operations.

3c – XiPay communicates with the merchant's backend processor to perform authorization or settlement.

4 – XiPay sends an authorization responses through PAS to SAP ERP or CRM system.

5 – An authorization response is available in SAP.

Workflow Without Intercept

1 – An authorization or settlement request is made from the SAP ERP or CRM system. For authorizations, a token is saved in the standard SAP credit card number database field.

2a – The ERP or CRM system sends an authorization or settlement request via a TCPIP RFC call through PAS to the appropriate XiPay Web Service operation.

2b – XiPay communicates with XiSecure as needed to perform tokenize/detokenize operations.

3 – XiPay communicates with the merchant's backend processor to perform authorization or settlement.

4 – XiPay sends the authorization response through PAS to SAP ERP or CRM system.

5 – The authorization response is available in SAP.